Vol 20 – An Exhausted Pause

- Ann Yu

- Apr 13, 2025

- 6 min read

April 13, 2025

Hello!

It’s been a wild ride, so let’s take a moment to appreciate that we’ve officially survived another exhausting week!

Where Do We Stand Now?

Trump hit pause on his reciprocal tariffs plan - giving it a 90-day timeout - and instead imposed a universal 10% tariff on all trade partners except China.

The US now slaps China with a 145% tariff, while China retaliates with 125%. Neither side seems ready to blink first.

Markets went full roller coaster mode:

S&P 500 tanked 9% (week ending Apr 4), then clawed back 5.7% (week ending Apr 11). Volatility hit levels not seen since 2008 financial crisis.

Treasuries in panic mode with US 10-year yield shot up from 3.99% to 4.49% within 5 days - the biggest weekly surge since 9/11.

Fed officials stepped in, reassuring that they would absolutely be prepared" to stabilize the market if conditions become disorderly." Wait, so we're not in disorder yet?

And on late Friday, far after market was closed, Trump administration announced exemptions for smartphones, laptops, hard drives, computer processors, memory chips, and semiconductor manufacturing equipment from the tariffs (including China!). The exemptions cover almost $390 billion in US imports, including more than $101 billion from China, which is about 22% of US imports from China in 2024.

Additionally, Trump hinted at potential exemptions to the 10% tariff for certain US trading partners, while simultaneously asserting that this rate was "pretty close" to a floor for countries negotiating trade deals.

If the logic feels hard to follow, you’re not alone - I’m struggling to make sense of it too! What’s in this week’s newsletter?

1️⃣ Money on the Move: Where Investors Are Headed Next? A summary of notable inflows and outflows in the past week.

2️⃣ Should we rebalance now? Many investors are looking to take advantage of this market shift to rebalance their portfolios. Here’s a look at historical portfolio rebalancing simulations and some ideas to help guide your approach.

Category | Contents for this Week |

1) Flows of the Week | |

2) Market Buzz |

Key things to watch for the upcoming week:

China/HK - Earnings | Apr 17 (Thu) - China Unicom (0762.HK) |

China/HK - Eco Data | Apr 16 (Wed) - China 1Q GDP |

US - Earnings | Apr 14 (Mon) - Goldman Sachs (GS) Apr 15 (Tue) - Bank of America (BAC), Citigroup (C), Johnson & Johnson (JNJ) Apr 17 (Thu) - United Health (UNH), Netflix (NFLX), Blackstone (BX) |

US – Eco Data | Apr 16 (Wed) - US March Retail Sales Apr 17 (Thu) - Fed Chair Powell Speech |

Other Events | Apr 16 (Wed) - Bank of Canada Rates Meeting Apr 17 (Thu) - European Central Bank Rates Meeting |

Flows of the Week – Money on the Move: Where Investors Are Headed Next?

Equities

Based on EPFR Global Data (cited by Bank of America for the week ending April 9), US stocks saw a whopping $48.9 billion in inflows. But here’s the real story - investors made their preferences crystal clear.

Style: Passive Funds like ETFs saw $70.3 billion of inflows, while actively managed funds saw $21.3 billion in redemptions - a sharp vote in favor of passive investing.

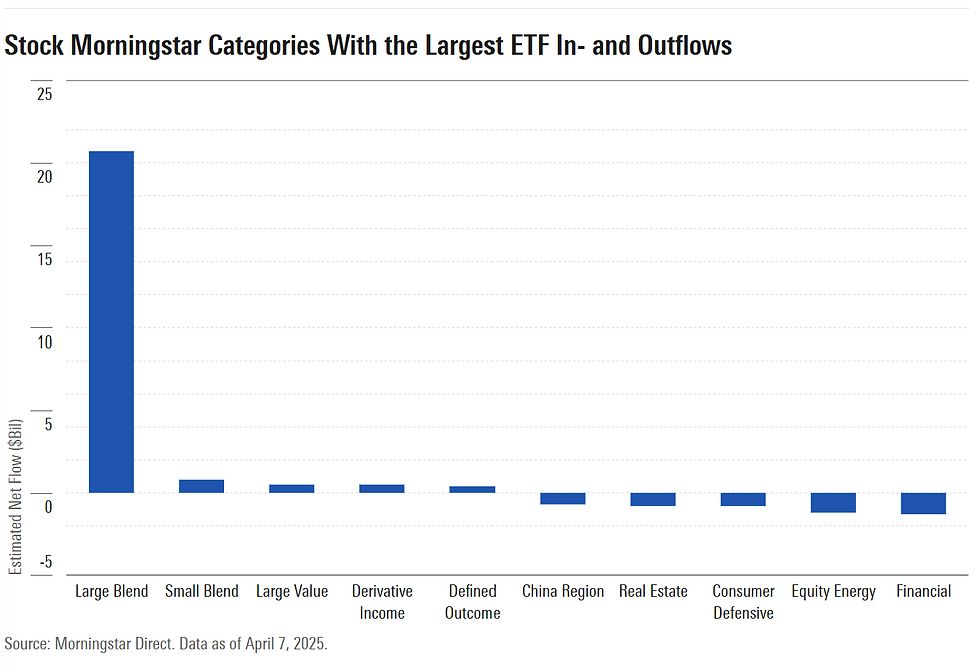

Sector: According to a Morningstar article, investors are laser-focused on Large Cap ETFs - pumping cash into funds that track S&P 500 index (like SPY and VOO) while pulling out of Financials and Energy sectors.

The trend is clear: big, broad, and liquid over sector-specific plays.

Fixed Income

Similar to equities, the same data set by EPFR Global Data for the week ending Apr 9 suggested a clear preference among different fixed income instruments:

Treasuries had the biggest weekly inflow ever at $18.8 billion

Investment Grade Bonds had its 1st outflow in 76 weeks at $12 billion

High Yield had its 3rd week of outflow at $15.9 billion

Emerging Market Debt outflow resumed at $3.6 billion

However, a massive wave of inflows into US Treasuries should, in theory, push yields down. But instead, yields have surged, signaling something deeper at play.

This is what’s keeping investors up at night. US Treasury Yield has long been the world's risk-free rate, the bedrock of global financial stability. If that status starts cracking, it could trigger a domino effect across markets, sending shockwaves worldwide.

As market uncertainty deepens, some investors are discreetly reallocating. German bunds are becoming the new go-to safe haven, with yields remaining remarkably stable this week while US 10-year yields have surged over 40 basis points.

Chart of US 10-Year Treasury Yield Weekly Change

Other Asset Classes

For the week ending Apr 9th

Gold saw $1.8 billion of inflow

Crypto saw $500m of outflow

Foreign Domiciled US-Focused Funds saw a $6.5 billion outflow as foreign confidence on the quality and leadership of US assets has been damaged.

For your reference only. Not investment/product recommendations.

Market Buzz – Should We Rebalance Now?

Several clients have been asking whether this market correction presents an opportunity to add to equities and rebalance their portfolios. To tackle this million-dollar question, we need to break it down into two parts:

What’s the most rational way to rebalance?

How should rebalancing be executed if there's a bear market coming?

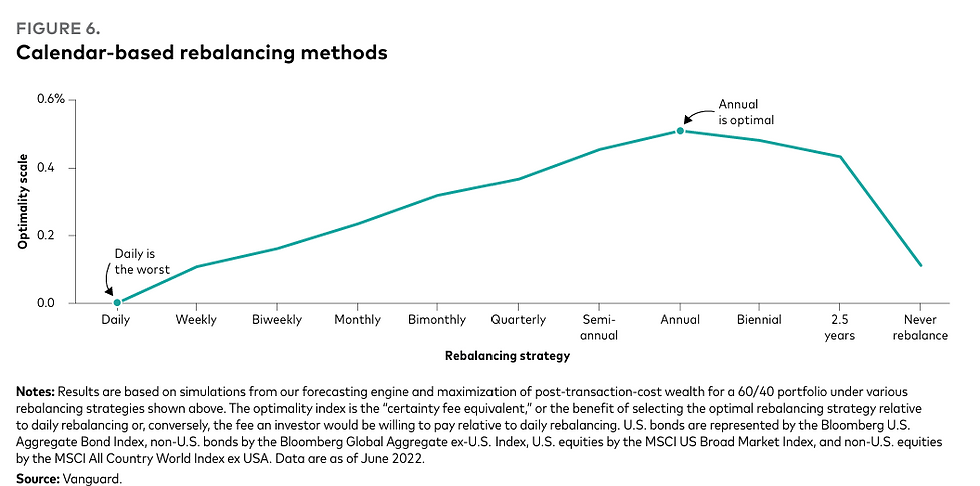

What is the most rational way to rebalance? There are 2 types of "rebalancing" here: Standard Rebalancing is to adjust the asset class weightings in the portfolio back to their original ratio, whereas Tactical Rebalancing aims to reshape the portfolio by adding stocks when they become cheaper. I've been reading tons of articles on portfolio rebalancing recently. For Standard Rebalancing, here's the key takeaway: Rebalancing shouldn’t be too frequent, nor too infrequent.

According to historical simulations done by Vanguard, the best rebalancing frequency is once a year. Why? Because markets are often momentum-driven - if you rush to rebalance at the first sign of every dip or uptick, chances are you won’t be trading at the best levels.

Tactical rebalancing is also top of mind for many clients, particularly those who have been underweighting stocks for an extended period.

However, with ongoing uncertainty and no clear resolution to the US-China trade war, a carefully planned execution strategy is more critical than ever.

How should rebalancing be executed if there's a bear market coming? How do we make smart moves if there really is a bear market coming our way? Here are some numbers to keep in mind: Since 1945, the S&P 500 has faced 15 bear markets (defined as declines of 20% or more):

Average bear market decline: 32%, vs. our current peak-to-trough drop of 18.9% (from 6144 on Feb 19, 2025, to 4983 on Apr 8, 2025 - technically not a bear market yet)

Average time to hit bottom: 11 months vs. where we are now - less than 2 months in

Average time to recover: 1.7 years

What history tells us is that the biggest risk in a bear market isn’t necessarily picking the wrong stocks. It's reacting poorly when fear takes over.

There are a few ways to tackle that:

Stick to high-conviction investments - companies you know well and believe in long-term, ones you wouldn’t panic over even if they dropped 20% overnight.

Have a plan, and don't let emotions hijack it. For example, set fixed investment amounts at pre-determined intervals, or establish clear profit-taking and loss-cutting levels and stick to them.

Having trouble crafting a plan that truly fits your needs? Jadewell Family Office is here to help - let’s brainstorm together and make sure we stay on track toward your financial goals!

For your reference only. Not investment/product recommendations.

About Jadewell Family Office

Jadewell is committed to offering proactive, customized services akin to a “single-family office,” yet within the ease of a “multi-family office” environment.

Ann Yu

Co-Founder and CEO

Jadewell Family Office

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY – NOT INTENDED FOR RETAIL CUSTOMER USETHESE ARE NOT STOCK OR PRODUCT RECOMMENDATIONS

This document is intended for informational purposes only. It should not be considered as advice or a recommendation for any specific investment product, strategy, plan feature, or any other purpose in any jurisdiction. It is educational and does not represent a commitment from Jadewell Family Office to participate in any mentioned transactions. Any examples used are generic, hypothetical, and for illustration purposes only.

This material is insufficient to support an investment decision and should not be relied upon to evaluate the merits of investing in securities or products. Users should independently assess the legal, regulatory, tax, credit, and accounting implications, and work with their own financial professional to determine if any mentioned investment is appropriate for their personal goals. Investors should ensure they have all relevant information before making any decisions.

Any forecasts, figures, opinions, or investment techniques and strategies provided are for informational purposes only. They are based on certain assumptions and current market conditions and are subject to change without prior notice.

All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.

It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Comments