Vol 36 - Shrugging Off the Shutdown - Too Soon?

- Ann Yu

- Oct 5, 2025

- 4 min read

October 5, 2025

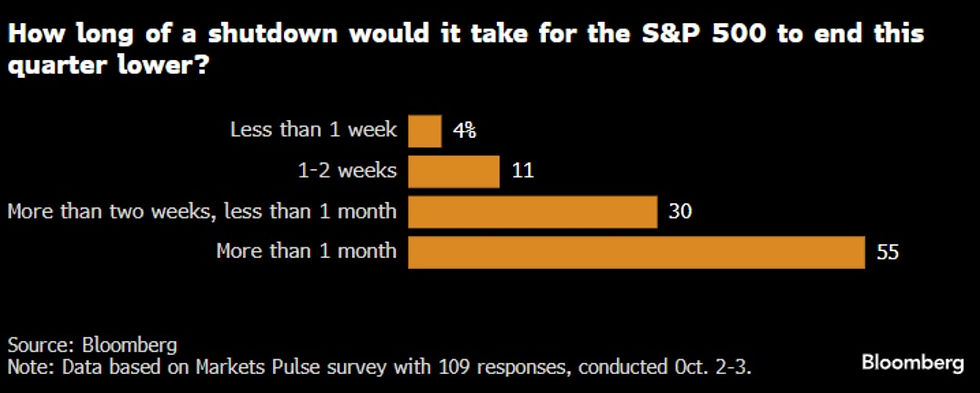

美國政府本周終於在兩黨政爭下關門了,但是股市似乎並沒有太過擔心,據彭博社統計,有超過一半的受訪者認為,這次政府得關門超過「一個月」,對股市才會造成負面的影響。

說是這麼說,但是政府關門最大的受惠者 -【黃金】,早就不停創下歷史新高了。

顯然投資者在不願放棄【美股上漲潛力】的同時,也知道要做好【資產分散】的兩手準備。

Contents of This Week's Newsletter

Social Media | |

|---|---|

Family Office Buzz | |

Next Week |

Topics from Jadewell's Social Media

😞 Yes the US Government is Shutting Down Again

Since 1981, the U.S. has shut down 14 times. The longest? 35 days from late 2018 to early 2019 - sparked by Trump’s demand for border wall funding.

Starting last Wednesday (October 1), the U.S. government has shut down again for the first time in seven years! How did it come to this? And what kind of impact could the shutdown have? 👉 Facebook (Chinese) / Instagram (English)

💊 TrumpRx is here - Trump's pharmacy goes live?!

While Wall Street’s been sweating over gov shutdown, one sector is quietly staging a comeback: Healthcare stocks! 🩺📈

Donald Trump has announced the launch of a government-led direct-to-consumer pharmaceutical platform called TrumpRx, expected to go live in 2026.

What does this platform represent - and what far-reaching impact could it have on the global pharmaceutical industry? 👉 Facebook (Chinese) / Instagram (English)

Private Credit Funds: All Roads Lead to AI

If you’ve been following us for a while, you’ll know we’ve covered Private Credit Funds extensively—from their declining returns to the “magic trick” of bundling illiquid assets into highly liquid ETFs for trading.

Yet despite these concerns, private credit funds remain hot sellers in the market. Sales reps often pitch them as the “perfect investment”:

✔️ Annual returns of 10–12%

✔️ Low correlation with traditional equities and bonds

✔️ Sounds almost too good to fail

But is it really that simple? A Bloomberg article last week caught our attention—and prompted us to take a fresh look.

🏦 The Original Mission of Private Credit

Private credit funds first gained traction when traditional banks tightened their lending standards. Many small and mid-sized businesses (SMEs), unable to secure loans, turned to private lenders.

These funds would then carefully select companies with strong fundamentals, reducing credit risk while delivering attractive returns to investors.

However, as banks have gradually loosened their lending criteria, SMEs are returning to traditional financing. Meanwhile, private credit funds - flush with capital - are facing a shortage of high-quality borrowers. This supply-demand imbalance is one of the key reasons behind falling returns.

🤖 A New Frontier: Financing AI Data Centers

The good news? Private credit funds may have found a new destination for their money - AI Data Centers.

According to Morgan Stanley, tech giants are expected to spend $2.9 trillion over the next three years building data centers. But their internal cash flow may only cover half of that. So where will the rest come from? You guessed it - private credit funds.

Even smarter, these tech companies aren’t just borrowing - they’re entering joint ventures with private credit funds. This way, the additional capital doesn’t show up as debt on their balance sheets.

🏗️ Why Data Centers Are the New Darling?

Large capital requirements: Ideal for deploying massive amounts of capital efficiently

Stable rental income: Once built, data centers can be leased to compute-hungry tech firms, generating predictable cash flow

⚠️ But Are We Overbuilding?

Morgan Stanley also warns: the projected revenue from generative AI over the next three years is around $1 trillion - far below the $2.9 trillion in infrastructure spending. How long can this mismatch last before market expectations need a reset?

Plus, with AI evolving rapidly, data center operators must frequently upgrade hardware to stay competitive. These ongoing costs could eat into the returns that private credit funds promise.

🤔 What Should Investors Watch For?

Private credit funds, once seen as low-correlation and stable-return vehicles, are now deeply intertwined with the AI boom.

For investors, this means that private credit funds may not be another "safe haven" to hide - it’s actually another chapter in the tech race.

All roads lead to AI - even for private credit. Are you ready for what’s next? Let’s talk to Jadewell Family Office today.

Key Events to Watch in the Week Ahead

US - Eco Data | Oct 9 (Thu) - FOMC Meeting Minutes, Powell Speech |

About Jadewell Family Office

Jadewell is committed to offering proactive, customized services akin to a “single-family office,” yet within the ease of a “multi-family office” environment.

Ann Yu

Co-Founder and CEO

Jadewell Family Office

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY – NOT INTENDED FOR RETAIL CUSTOMER USETHESE ARE NOT STOCK OR PRODUCT RECOMMENDATIONS

This document is intended for informational purposes only. It should not be considered as advice or a recommendation for any specific investment product, strategy, plan feature, or any other purpose in any jurisdiction. It is educational and does not represent a commitment from Jadewell Family Office to participate in any mentioned transactions. Any examples used are generic, hypothetical, and for illustration purposes only.

This material is insufficient to support an investment decision and should not be relied upon to evaluate the merits of investing in securities or products. Users should independently assess the legal, regulatory, tax, credit, and accounting implications, and work with their own financial professional to determine if any mentioned investment is appropriate for their personal goals. Investors should ensure they have all relevant information before making any decisions.

Any forecasts, figures, opinions, or investment techniques and strategies provided are for informational purposes only. They are based on certain assumptions and current market conditions and are subject to change without prior notice.

All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.

It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Comments