Vol 37 - Adapting to Change

- Ann Yu

- Oct 12, 2025

- 6 min read

October 12, 2025

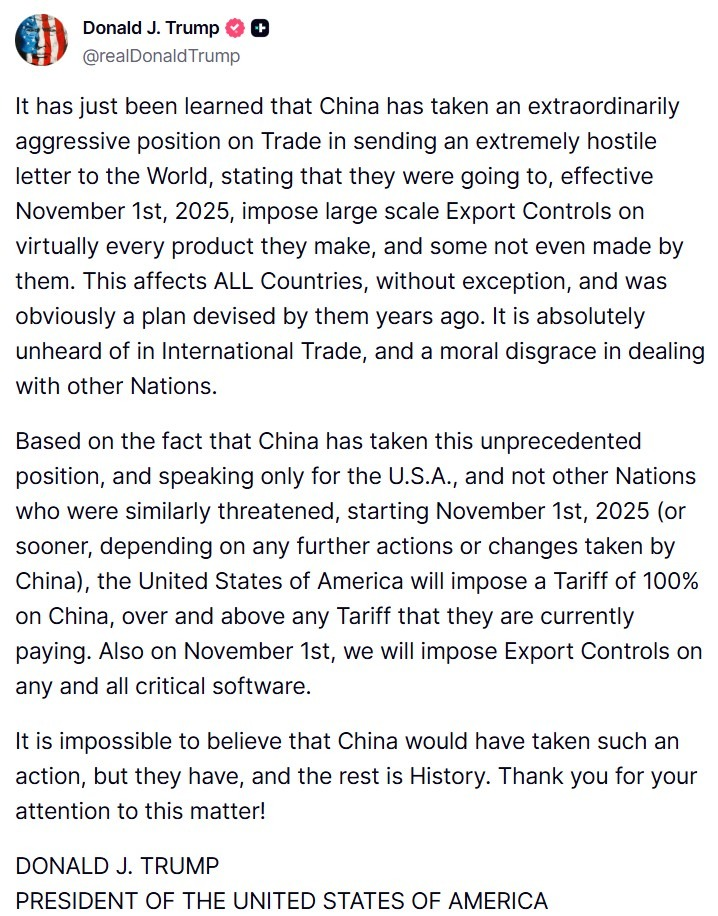

Just when everyone was starting to forget about the U.S.–China trade war, a flurry of tweets from President Trump on Friday reignited tensions — and gave the markets a fresh excuse to pull back.

This week, we received the monthly report from a hedge fund I deeply admire: Fenghe Asia.

In the report, they wrote: “We remain mindful that humility is the foundation of discipline. Markets will always test us, and the greatest risk is complacency.”

A few weeks ago, we issued a similar reminder: When the market is flooded with self-proclaimed "stock gods", and anyone can toss out “sure-win” stock tips without accountability — do we still remember the importance of humility and discipline?

Beyond the trade tensions, U.S. earnings season starts next week, and there's the Federal Reserve’s rate decision at the end of October.

And don’t forget Japan.

Conservative hardliner Sanae Takaichi has won the presidency of Japan’s largest party, the Liberal Democratic Party (LDP). But LDP has long relied on political alliances to maintain power. Earlier this week, the Komeito Party announced its withdrawal from a 26-year coalition with the LDP, citing dissatisfaction with Takaichi’s handling of political corruption — leaving the LDP without a stable majority in parliament.

So what’s next for global markets?

Will we see a repeat of last August’s yen carry trade unwind, triggering global tremors? Or will it echo April’s “Tariff Liberation Day,” when markets snapped back in a blink?

Unfortunately, unless you’re a tapeworm inside the minds of top U.S.–China leadership, no one knows the answer.

As Sun Tzu wrote in The Art of War:

“Water shapes its flow by the terrain; armies shape their victory by the enemy. Thus, there is no fixed posture in warfare, just as water has no constant form. The one who triumphs by adapting to change — that is true mastery.”

《孫子兵法·虛實篇》- 「水因地而制流,兵因敵而制勝。故兵無常勢,水無常形;能因敵變化而取勝者,謂之神」。

We continue to believe that humility and discipline are the cornerstones of long-term success, and that a flexible, adaptive portfolio remains the most effective strategy in uncertain markets.

Talk to Jadewell Family Office today and see how we can help with that!

Contents of This Week's Newsletter

Social Media | An Untrue (But Funny) Story - The Legend of the AI Knights Trading in the Shadow of the '70s |

|---|---|

Family Office Buzz | |

Next Week |

Topics from Jadewell's Social Media

🦸 An Untrue (But Funny) Story for Mid-Autumn Break

- The Legend of the AI Knights

The AI world has been in turmoil lately — rival powers are forming alliances and plotting to seize the central battleground.

If this were told through a funny, fictional story with certain Chinese elements, what would the backdrop look like 👉 Facebook (Chinese) / Instagram (English)

🪶 Trading in the Shadow of the '70s - Same as It Ever Was

Lately, clients keep asking me: “What’s the next move?”

Ray Dalio of Bridgewater has offered a direction — he believes today’s market is strikingly similar to the early 1970s.

And since some of the readers might not be familiar with what happened back then, this post looks to the past for insight 👉 Facebook (Chinese) / Instagram (English)

Heard at the "World Family Office Forum" - Voices of Legacy

This week, we joined the World Family Office Forum held in Hong Kong, engaging in thoughtful exchanges with family offices and funds from around the world.

While the forum featured impressive discussions on investment strategies and governance structures, the most moving moments came from the deep conversations on family legacy and succession.

👨👩👧👦 Legacy isn't just about passing down wealth - it's about carrying forward love.

One Southeast Asian family attended the forum with the father accompanied by his two adult children.

He spoke on stage with a relaxed tone, but every word carried weight. “I never ‘test’ my children,” he said. “Because if they fail… I wouldn’t know what to do.”

That honesty struck a chord.

Rather than adopting a tiger-parent approach, this father chose companionship and trust — allowing his children to naturally resonate with the family’s values.

It reminded me of a lyric from Faye Wong: “If you haven’t found the answer, don’t go looking for the question (沒想到答案,就不要尋找題目).”

Perhaps it’s empathy and understanding that truly draw the next generation back home.

🧭 Freedom isn't demanded - it's earned.

Another speaker, a second-generation member from Singapore, was more direct.

He shared that his family had several sons, and his father had long ago chosen one to inherit the family business. The others were given seed capital — and told to make their own way.

He was one of those who ventured out. Thankfully, he did well.

His advice to the audience was blunt: “Young Asians — stop trying to convince your parents. It’s impossible.”

But what he said next was the real gem: “The leash will never disappear — but you can try to make it longer.”

In family enterprises, freedom and respect are always earned through real results.

📈 Going public: the ultimate stress test for family governance.

Several speakers noted that "listing" a part of family business is one of the most challenging — yet transformative — decisions a family can make.

The process of preparing for an IPO forces families to confront tough questions from banks, exchanges, and investors — prompting a deep reevaluation of culture, systems, and decision-making logic. It’s not just a financial maneuver — it’s a crucible for building consensus and passing down values.

And the ongoing disclosures and compliance required to stay listed? They become a long-term accountability mechanism for governance itself.

💬 Is your family also thinking about legacy and governance?

Did these stories resonate with you? Perhaps your family is standing at a similar crossroads?

Talk to Jadewell Family Office today and explore what’s next together.

Key Events to Watch in the Week Ahead:

US - Kicking Start the Earnings Season

Oct 14 (Tue) - JPM, JNJ, WFC, GS, C

Oct 15 (Wed) - BAC, MS, ASML

Oct 16 (Thu) - TSM

Other Key Events

Oct 13-16 - Oracle AI World

US - Eco Data (Pending due to Govt Shutdown)😅

Oct 16 (Thu) - Retail Sales

About Jadewell Family Office

Jadewell is committed to offering proactive, customized services akin to a “single-family office,” yet within the ease of a “multi-family office” environment.

- Tailor-Made Investment Advisory Services

- Portfolio Consolidation Across Banks

- Zero Commission Model

- Decades of Experience Across Leading Global Private Banks

Ann Yu

Co-Founder and CEO

Jadewell Family Office

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY – NOT INTENDED FOR RETAIL CUSTOMER USETHESE ARE NOT STOCK OR PRODUCT RECOMMENDATIONS

This document is intended for informational purposes only. It should not be considered as advice or a recommendation for any specific investment product, strategy, plan feature, or any other purpose in any jurisdiction. It is educational and does not represent a commitment from Jadewell Family Office to participate in any mentioned transactions. Any examples used are generic, hypothetical, and for illustration purposes only.

This material is insufficient to support an investment decision and should not be relied upon to evaluate the merits of investing in securities or products. Users should independently assess the legal, regulatory, tax, credit, and accounting implications, and work with their own financial professional to determine if any mentioned investment is appropriate for their personal goals. Investors should ensure they have all relevant information before making any decisions.

Any forecasts, figures, opinions, or investment techniques and strategies provided are for informational purposes only. They are based on certain assumptions and current market conditions and are subject to change without prior notice.

All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.

It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Comments